Most people think “law” only matters when something goes badly wrong—lawsuits, arrests, court dates. In reality, the legal system quietly shapes many everyday purchases: your phone plan, a used car, a streaming subscription, even a gym membership. Knowing a bit of law and government policy can help you avoid traps, protect your money, and make smarter buying decisions without needing a lawyer on speed dial.

This guide walks through how basic legal awareness connects to everyday shopping, what protections you already have, and how to use them. Along the way, you’ll get five practical tips you can apply on your very next purchase.

How Law Quietly Shapes Everyday Buying

Every contract you click “I agree” on is grounded in contract law, consumer protection rules, and sometimes sector-specific regulations. You may not read the fine print, but companies write it around the rules they’re required to follow—and sometimes to push right up against the line of what’s allowed.

For example, federal and state laws restrict “unfair or deceptive acts or practices.” That’s why ads have disclaimers, why credit card offers must show APR and fees clearly, and why there are rules around things like “free trials.” Warranty law affects what happens when a product fails earlier than it should. Privacy laws influence how your data is used when you buy online. And government agencies—from state attorneys general to the Federal Trade Commission (FTC) and Consumer Financial Protection Bureau (CFPB)—enforce these rules.

As a buyer, you don’t need to memorize statutes. But knowing that protections exist, and where to look them up, changes how you shop. You can treat contracts as negotiable sometimes, warranties as real leverage, and “no refunds” signs as not always the final word.

Practical Tip #1: Before big purchases, search “[product or service] + your state + ‘consumer rights’”

You’ll often find your state attorney general’s consumer page, which explains local rules on contracts, returns, car sales, home improvements, and more—giving you leverage before you sign or pay.

Contracts You Click: Making Sense of the Fine Print

Most modern buying involves a contract—sometimes written, sometimes digital. Cell phone plans, home security services, software subscriptions, “buy now, pay later” options, and even some appliance purchases come with pages of terms.

Key things to watch for:

- **Automatic renewals**: Many subscriptions renew unless you cancel in a specific way (online vs. phone, certain notice period, etc.). Some states now require clear auto-renewal disclosures and easy cancellation.

- **Early termination fees**: Service contracts—gyms, alarm systems, phone plans—may charge if you cancel early. Sometimes they must be “reasonable,” and some states limit or regulate them.

- **Forced arbitration and class-action waivers**: These clauses push disputes out of court and stop you from joining class actions. They don’t mean you have no rights—but they do change your options.

- **Choice-of-law and venue clauses**: The contract might say that disputes are governed by another state’s law or must be resolved in a faraway place, which can be costly for consumers to fight.

The law often requires that key terms be clear and not “unconscionable” (grossly unfair). If a term is hidden or contradictory, a court or regulator might strike it down. But you’re in a much stronger position if you spot red flags before you sign.

Practical Tip #2: Search the contract or terms for these words before agreeing: “renew,” “cancel,” “fee,” “arbitration,” and “class action.”

If you find something troubling—like automatic renewal with a long notice period—ask customer service to confirm your ability to cancel in writing (chat transcript, email) or consider a competitor with cleaner terms.

Government Protections You Already Have (But Might Not Use)

Many buyers underestimate how much protection the law already gives them—and never use it. Depending on the product and where you live, you might have:

- **Implied warranties**: In the U.S., most goods sold by a merchant carry an “implied warranty of merchantability,” meaning they should work as ordinary products of that type. This can apply even if the written warranty is short or restrictive.

- **Cooling-off periods**: Certain door-to-door sales and some high-pressure purchases (like timeshares) may come with a legal right to cancel within a set number of days.

- **Lemon laws**: New vehicles that repeatedly fail to meet quality and performance standards may qualify for replacement or refund under state lemon laws.

- **Truth-in-lending protections**: Credit offers must disclose interest rates, fees, and terms in standardized ways so you can compare deals.

- **Fair credit and debt rules**: Laws limit how debt collectors can behave and give you rights to dispute billing errors and inaccurate credit reporting.

The catch: many of these protections aren’t automatic in practice. Companies may not volunteer what you’re entitled to; you often have to ask clearly, in writing, and reference specific rights (like warranties or “state lemon law”).

Practical Tip #3: For any major purchase that fails early, write a short, dated letter or email referencing “implied warranty” and your state’s name, and send it to the seller and manufacturer.

Clearly state the problem, what you want (repair, replacement, refund), and a response deadline. You don’t need legal language—just a record asserting your rights can change how seriously your complaint is handled.

Avoiding Common Legal Traps in Everyday Purchases

Some sectors have a history of consumer complaints and legal disputes: used cars, home improvement, timeshares, extended warranties, and long-term service contracts. Laws exist here, but so do well-practiced sales tactics.

Watch for these patterns:

- **High-pressure, “today only” offers**: Urgency is often used to rush you past your right to think, compare, or read.

- **Verbal promises not written into the contract**: If it’s not in writing, it’s hard to enforce later. Sales reps may be sincere but overoptimistic—or gone when issues arise.

- **Complex fee structures**: Hidden fees, add-ons, and optional services that are framed as “required.” This is common in auto sales, telecom services, and ticketing.

- **Third-party financing**: “No interest for 12 months” can turn into high-rate debt if you miss one term or payment.

Consumer protection agencies repeatedly warn about these tactics, and lawsuits often follow. The safest route is to slow the process down, separate the product decision from the financing decision, and insist that every promise you care about appears in the written agreement.

Practical Tip #4: For any contract you sign in person, step outside (or off the call) and take 10 minutes alone to read just three things: the price, the term (how long it lasts), and all cancellation/penalty clauses.

If any of those are unclear or feel wrong, don’t sign on the spot. Ask for a copy or screenshot of the terms so you can review later or compare alternatives.

How (And When) to Use Government Help

You don’t have to handle every dispute alone. When you hit a wall with a company—especially for deceptive practices, recurring problems, or significant money—government tools can help.

Options often include:

- **Filing complaints with regulators**: Agencies like the FTC, CFPB, state attorneys general, and local consumer protection offices track complaints and sometimes intervene—especially when they see patterns.

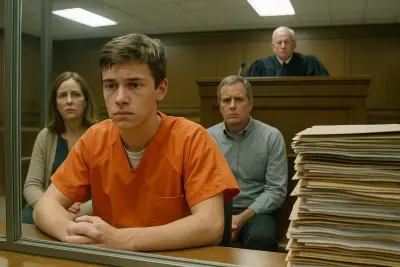

- **Small claims court**: Designed for individuals to resolve lower-value disputes without an attorney. Limits vary by state, but it can be an effective way to enforce a contract or warranty.

- **Mediation and arbitration programs**: Some industries and local governments offer low-cost dispute resolution. Even when arbitration is mandatory under a contract, you can sometimes choose between forums and procedures.

- **Legal aid and consumer clinics**: Law schools and nonprofit legal organizations often help with consumer issues, especially for lower-income residents.

Using these channels is more effective when you’re organized. Save contracts, receipts, emails, chat logs, screenshots, and notes of phone calls (with dates and names). A clear timeline plus legal keywords—“breach of contract,” “warranty claim,” “unfair and deceptive practice”—help reviewers understand your issue quickly.

Practical Tip #5: If a company stonewalls you, file a complaint with the relevant government agency and send the company a link or copy of the complaint.

Many firms have specialized teams that respond when a regulator is copied; this can move your case to someone empowered to fix it.

Conclusion

Law and government might sound distant from everyday shopping, but they shape nearly every dollar you spend. Contracts, warranties, disclosures, cooling-off periods, and dispute-resolution rules all exist to set the boundaries of fair dealing. When you recognize those boundaries—and know where to look for help—you stop being just a “customer” and start acting like a protected party under the law.

You don’t need to become a lawyer. You just need a basic habit: pause before you commit, scan the important terms, know that consumer protections exist, and be willing to assert them in writing. With that mindset, your purchases become not only smarter—but safer, more confident, and more aligned with your rights.

Sources

- [Federal Trade Commission – Consumer Advice](https://consumer.ftc.gov/) - U.S. government guidance on contracts, warranties, scams, subscriptions, and consumer rights

- [Consumer Financial Protection Bureau – Consumer Tools](https://www.consumerfinance.gov/consumer-tools/) - Official information on credit cards, loans, “buy now, pay later,” and how to file complaints

- [USA.gov – Consumer Issues](https://www.usa.gov/consumer-issues) - Central federal resource on resolving consumer problems and contacting agencies

- [National Association of Attorneys General – Find Your AG](https://www.naag.org/find-my-ag/) - Helps you locate your state attorney general’s office for local consumer protection information

- [Nolo – Consumer Protection & Warranty Law Overview](https://www.nolo.com/legal-encyclopedia/consumer-protection-warranty-law) - Plain-language explanations of consumer and warranty laws in the U.S.

Key Takeaway

The most important thing to remember from this article is that this information can change how you think about Law & Government.