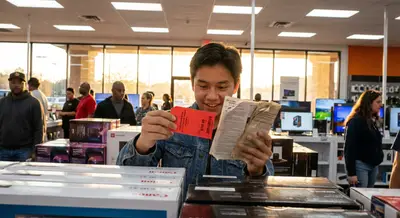

Most people think “law and government” only matter when something big goes wrong—a lawsuit, an arrest, a tax audit. But your daily purchases are quietly shaped by laws, regulations, and public policy: from the warranty on your laptop to the safety of your child’s car seat and what happens when a package never arrives.

Understanding a few key consumer protections can help you spend smarter, avoid scams, and know when to push back. This guide breaks down how law and government affect what you buy—and how to use that knowledge to protect your money.

How Government Shapes What You’re Allowed to Buy

Government doesn’t just collect taxes; it sets the rules for what can be sold, how it must be labeled, and what happens if a product is unsafe.

In the U.S., agencies like the Federal Trade Commission (FTC) and Consumer Product Safety Commission (CPSC) oversee advertising, safety standards, and recalls. Food and drugs are regulated by the FDA, while state and local governments can add their own requirements—like bottle deposit laws, used car rules, or home improvement licensing.

This matters when you’re choosing between similar products or services. That safety label on a helmet, for example, isn’t just marketing—it often means the product meets a government-backed standard. On the flip side, “all natural” or “chemical-free” may be loosely defined and more about branding than regulation.

For high-risk purchases (like baby gear, used cars, home repairs, or financial services), knowing which rules apply—and who enforces them—helps you judge whether a seller is genuine, compliant, or cutting corners.

Your Legal Safety Net: Warranties, Returns, and Refunds

Whenever you buy something, you’re entering into a basic legal relationship with the seller, whether it’s written down or not. Law fills in the gaps of that relationship when things go wrong.

Most countries have some form of “implied warranty” laws—meaning a product must at least be fit for its ordinary purpose, even if the seller doesn’t promise anything in writing. In the U.S., the Magnuson–Moss Warranty Act regulates written warranties and requires certain clarity when a warranty is called “full” or “limited.” Many states add extra protections for defective goods or “lemon” vehicles.

Retailers overlay their own return and refund policies on top of that legal foundation. These policies might be more generous than the law requires, but they must still be truthful and clearly disclosed. Some industries—like credit cards, airline tickets, or online subscriptions—have specific legal rules about cancellations and refunds that your seller can’t override.

When you know the difference between what’s legally required and what’s just store policy, you’re in a stronger position to negotiate, escalate complaints, or decide if paying for an extended warranty actually makes sense.

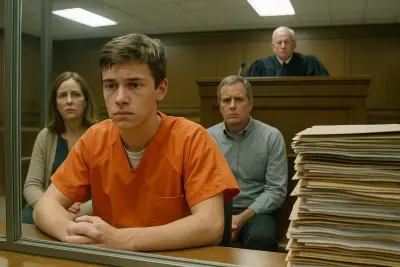

Spotting Red Flags: When “Government” Is Used to Mislead You

Scammers and shady marketers like to borrow the language and symbols of government to appear legitimate. They may use logos that resemble official seals, claim to be “approved by” a federal agency, or hint that a product meets “government standards” without saying which ones.

Real government approvals are usually very specific and traceable. For example, an FDA-approved medical device will have a clear approval number and category, and safety certifications for products (like UL or CE marks) follow defined technical standards. Vague claims like “Scientifically proven” or “Government-grade” should make you pause and verify before buying.

Debt relief, student loan help, and immigration-related services are especially prone to this kind of misrepresentation. Many official programs are actually free, while third-party companies charge “processing” or “expediting” fees for filling out forms you could do yourself through an official .gov site.

Knowing where to find official information—and how to double-check whether a program is truly government-backed—can protect you from expensive, high-pressure pitches that lean on fake authority.

Five Practical Tips for Smart Purchasing Under Real-World Rules

Here are five concrete ways to use law and government knowledge to improve your everyday buying decisions:

1. Check for Recalls Before (and After) You Buy

Before buying cars, baby gear, electronics, or major appliances—especially used—take a minute to search official recall databases. In the U.S., the CPSC, NHTSA (for vehicles), and FDA (for food and medicine) maintain searchable lists.

Buying used? Ask for a serial number or VIN, then search it. Once you own the item, register it with the manufacturer when possible—recall notices often depend on registration.

Why it’s smart: You avoid products already known to be dangerous or defective, and you may get free repairs or replacements if a recall happens later.

2. Read the Warranty Like a Contract, Not a Marketing Line

Instead of just seeing “2-year warranty” and feeling safe, dig into what’s covered and what’s excluded. Look for:

- Who is providing the warranty (manufacturer vs. retailer)

- Whether labor, parts, and shipping are included

- Whether “normal wear and tear” is excluded

- How you’re required to prove a defect (photos, inspection, proof of purchase)

Then compare it to your likely risk. A cheap item that’s cheap to replace rarely needs an extended warranty, while a complex product with expensive repairs might. Also check if your credit card already extends warranties at no extra cost.

Why it’s smart: You avoid paying for redundant or weak protection and know exactly what to expect if something fails.

3. Use the “Cooling-Off” and Dispute Options You Already Have

Many legal systems offer “cooling-off” periods for certain purchases—especially those made at your home, via telemarketing, or in high-pressure situations (like timeshares or door-to-door sales). Credit card networks also have dispute rights when a product isn’t delivered or is significantly not as described.

Before you buy from a nontraditional seller, ask yourself:

- Is there a legal cooling-off period for this type of purchase in my area?

- Am I paying with a method that gives me dispute rights (like a major credit card)?

- Does the contract mention mandatory arbitration or limited remedies?

If something goes wrong, act quickly—many rights have strict deadlines. Contact the seller first, but know you may have backup routes through your bank, card issuer, or a government consumer protection office.

Why it’s smart: You give yourself multiple layers of defense if a transaction goes bad or a seller stops cooperating.

4. Verify Licenses and Registrations for High-Risk Services

For services that can cause real financial or physical harm—contractors, car dealers, financial advisors, moving companies, childcare providers—government oversight can be your friend.

Before you hire or sign:

- Search for the business in your state or local licensing database

- Look for complaints or enforcement actions through consumer protection offices

- Confirm any claimed certifications with the organization that grants them

If someone refuses to show a license or gives vague answers about regulatory oversight, consider that a serious warning sign.

Why it’s smart: You reduce the risk of paying someone who cannot legally do the work or who has a track record of violations and consumer complaints.

5. Treat “Official” and “Urgent” Messages With Maximum Skepticism

Scammers often pose as government agencies or authorized partners to push fake fines, “expiring” benefits, or limited-time registration offers. Typical pressure tactics include threats of arrest, license suspension, or immediate legal action unless you pay right away—often via gift cards, wire transfer, or cryptocurrency.

Before responding:

- Check the sender’s email domain or phone number

- Go directly to the official website (ending in .gov or well-known company domains), not links in the message

- Call the agency or company using a publicly listed number to confirm

Real government agencies generally don’t demand payment in unusual forms or require you to disclose full Social Security numbers, passwords, or one-time codes via email or text.

Why it’s smart: You avoid emotional, rushed purchases or payments that exploit fear of government authority.

When and How to Ask Government for Help

You’re not expected to know every law. But you should know where to go when you suspect something is wrong.

Many countries and regions have a central consumer protection office or ombudsman that collects complaints, mediates disputes, and uses patterns of complaints to bring enforcement actions. In the U.S., agencies like the FTC, state attorneys general, and local consumer affairs departments all handle different parts of the landscape.

If you’re dealing with a recurring billing issue, misleading advertising, refused refunds on clearly defective products, or questionable “government-related” services, filing a complaint can:

- Help you individually (sometimes ledgers are resolved after regulators get involved)

- Protect others by documenting patterns of abuse

- Signal to companies that customers are paying attention to their legal obligations

Before you escalate, gather documentation: receipts, screenshots, emails, contracts, and the timeline of what happened. Even if you never end up in court, the law is more on your side when you’re organized.

Conclusion

Law and government aren’t just background noise—they’re part of every purchase you make, from a streaming subscription to a secondhand stroller. When you understand how regulations, warranties, recalls, and dispute rights work, you’re no longer just hoping a company treats you fairly. You know what you can insist on.

By checking for recalls, reading warranties carefully, using cooling-off and dispute rights, verifying licenses, and questioning anything that claims to be “official” and “urgent,” you build a practical legal shield around your daily spending. You won’t avoid every bad purchase—but you’ll avoid the most expensive mistakes, and you’ll be prepared when something does go wrong.

Sources

- [Federal Trade Commission – Consumer Advice](https://www.consumer.ftc.gov/) – U.S. government guidance on scams, warranties, refunds, and consumer protection laws

- [USA.gov – Consumer Issues](https://www.usa.gov/consumer-issues) – Central hub for finding official agencies, filing complaints, and learning about rights in common consumer situations

- [U.S. Consumer Product Safety Commission – Recalls](https://www.cpsc.gov/Recalls) – Searchable database of product recalls, safety alerts, and guidance on what to do if you own a recalled product

- [National Highway Traffic Safety Administration – Vehicle Recalls](https://www.nhtsa.gov/recalls) – Official database for checking vehicle and equipment recalls using VIN and product information

- [U.S. Food & Drug Administration – Recalls, Market Withdrawals & Safety Alerts](https://www.fda.gov/safety/recalls-market-withdrawals-safety-alerts) – Information on recalled foods, medicines, and medical products, plus background on regulatory authority

Key Takeaway

The most important thing to remember from this article is that this information can change how you think about Law & Government.