Most people think of “law and government” as something distant—courtrooms, elections, and complicated bills. But consumer laws quietly shape everyday decisions: which warranty you choose, how subscriptions renew, what happens when a shipment never shows up, and how easy it is to return a bad purchase.

Understanding a few key legal protections can turn you from a passive buyer into a confident, rights-aware shopper. This guide breaks down how public rules affect private purchases—and how to use them to protect your money.

How Government Rules Shape Everyday Purchases

Consumer protection laws exist to balance power between buyers and sellers. Companies usually write the contracts, set the prices, and control the fine print. Government rules step in to set minimum standards: truth in advertising, clear disclosures, and basic product safety.

In the United States, federal agencies like the Federal Trade Commission (FTC), Consumer Financial Protection Bureau (CFPB), and Food and Drug Administration (FDA) oversee everything from credit card disclosures to food labels and online advertising. State governments add their own rules, such as “cooling-off” periods for specific contracts or extra protections against deceptive practices.

Even if you never read a law, you feel the impact when you see standardized nutrition labels, clear APRs on credit offers, or “free trial” terms spelled out in small print. These regulations are meant to help you compare options more fairly and avoid surprises. When you know how they work, you can spot red flags faster, document problems better, and push back when a seller crosses the line.

Key Consumer Rights Most Shoppers Overlook

Many buyers assume “all sales are final” unless a store is being generous. In reality, your rights are often broader than store policies suggest.

You typically have legal protection against false advertising and deceptive pricing. That means a business cannot bait you with one deal and switch you to something else without clearly disclosing it, or advertise a feature that simply doesn’t exist. For credit-related purchases—financing a phone, buying an appliance on store credit, or opening a retail card—truth-in-lending rules require clear disclosure of interest rates, fees, and total costs.

You also have rights around data and privacy. Retailers and apps that collect your personal information must follow certain rules about consent, use, and security; some states give you the right to see, delete, or limit the sale of your data. On the product side, safety laws and recall systems exist for everything from children’s toys to vehicle parts. Manufacturers must address certain safety defects, and you can often get a repair or replacement even after the normal store return window if a recall is issued.

Finally, many states provide “implied warranties”—basic expectations that a product will work as advertised for a reasonable time—even if the seller doesn’t mention a warranty at all. Knowing this can make a big difference when something breaks just outside the stated return period.

Practical Tip #1: Read Disclosures Like a Contract, Not a Slogan

Marketing copy is meant to persuade; disclosures are meant to inform. When you’re making a bigger or ongoing purchase—anything financed, subscription-based, or involving your data—focus on the legally required details, not the headline offer.

Look for sections labeled “Terms and Conditions,” “Privacy Policy,” “Loan Agreement,” or “Subscription Terms.” These documents might feel boring, but they contain the information companies are required by law to show you: interest rates, length of contracts, cancellation procedures, automatic-renewal clauses, and possible penalties. Compare these across options instead of just comparing monthly prices or promotional perks.

Before accepting, ask yourself: How long am I locked in? What happens if I miss a payment? Does this price go up after an introductory period? How hard is it to cancel? This approach uses the government-enforced transparency rules in your favor, turning what most people skip into your buying advantage.

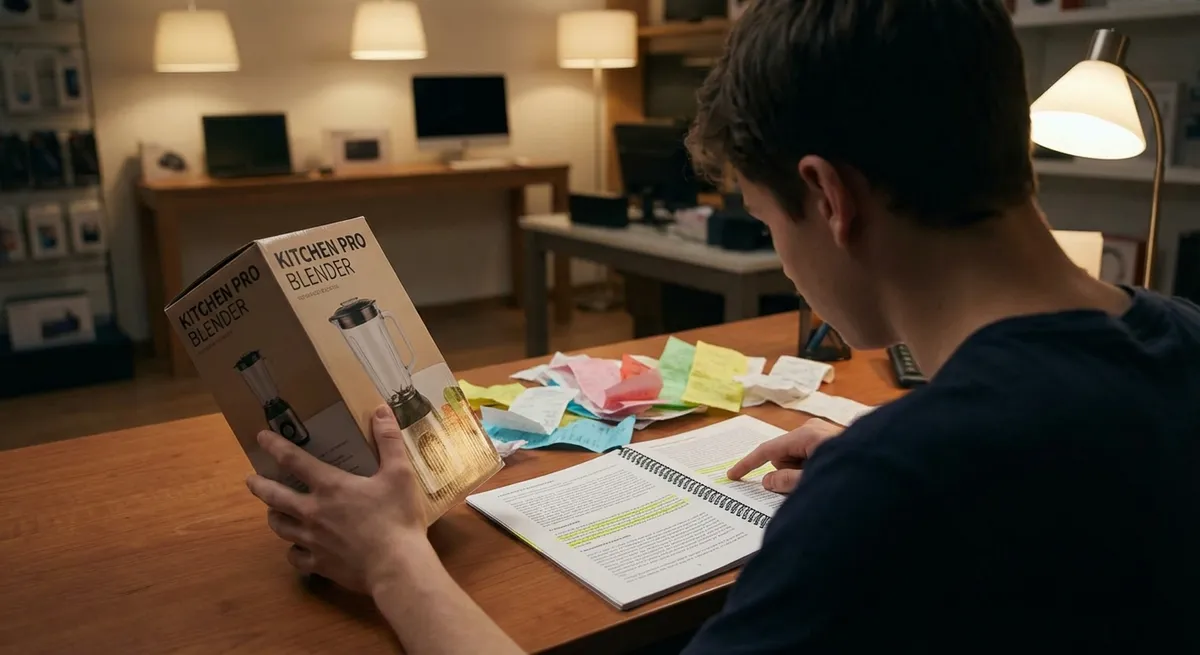

Practical Tip #2: Use Return Policies and Implied Warranties Strategically

Return policies are part of the legal agreement between you and the seller, but they’re not the whole story. A store might say “30-day returns only,” yet you may still have protections if the product is defective, unsafe, or not as described.

Before buying, read the return and warranty sections carefully: who pays return shipping, whether you get a refund or store credit, and if there are restocking fees. Save a screenshot or photo of the policy at checkout, especially for big-ticket items or online purchases. If a product arrives damaged, malfunctioning, or clearly different from what was advertised, document everything with photos and dates, and contact the seller in writing.

If the seller refuses to help and the product fails unusually early, look up your state’s implied warranty or consumer protection laws—often available on state attorney general websites. You may discover you’re still entitled to a remedy. Presenting your case using the right legal terms (“implied warranty of merchantability,” “not as advertised,” “defective product”) can make customer service more responsive.

Practical Tip #3: Protect Yourself With Smart Payment Choices

The way you pay can dramatically change your protection if something goes wrong. Laws around billing errors, fraud, and disputes often treat payment methods differently.

Credit cards typically offer the strongest legal protection for purchases, especially online. Under federal law, if you report unauthorized charges promptly, your liability is limited, and you can dispute charges for goods that never arrived or were misrepresented. Many cards extend these protections with purchase protection or extended warranty benefits. Debit cards and bank transfers can be riskier: your money leaves your account immediately, and getting it back can be slower or more difficult.

For larger or riskier purchases (unknown sellers, expensive electronics, custom items), consider using a payment method with robust dispute rights instead of cash, wire transfers, or peer-to-peer apps. Keep all receipts, confirmation emails, and tracking information; these become key evidence if you need to invoke your rights under billing and consumer protection laws.

Practical Tip #4: Verify Licensing, Safety, and Compliance Before You Buy

For certain products and services, government licensing and safety rules are your best early-warning system. If a business isn’t properly licensed or a product bypasses safety standards, that’s a sign to reconsider.

For services like home repairs, legal help, childcare, or medical treatments, check whether the provider needs a license in your area and confirm it through official government or professional board websites, not just their own marketing. Licensed professionals are typically subject to codes of conduct and disciplinary procedures, giving you more recourse if something goes wrong.

For physical products, especially those affecting health and safety—baby gear, cosmetics, supplements, vehicles, electronics—check for regulatory approvals or certifications where relevant, and search for recalls. Government databases make it easy to see if items have been flagged for risks like fire hazards, contamination, or structural failure. Spending a few minutes checking these sources before checkout can prevent costly—and potentially dangerous—mistakes.

Practical Tip #5: Use Complaint Systems and Public Records as a Shopping Tool

Complaint systems and enforcement records aren’t just for when things go wrong; they can also guide better purchases upfront. Government and independent organizations collect and publish information on consumer issues that never appears in marketing materials.

Before committing to a long-term contract (internet service, gym membership, alarm system, extended warranty) or a major purchase (roofing, solar panels, used car), search your state attorney general’s site, the FTC’s resources, and consumer complaint databases for the company’s name. Patterns of unresolved complaints about billing, quality, or misleading claims are a strong signal to look elsewhere.

If a purchase does go bad, don’t stop at arguing with customer service. Many businesses take complaints more seriously when you reference filing with a regulator or watchdog. You can submit complaints to agencies that oversee financial products, communications services, and general consumer matters. These systems don’t guarantee a refund, but they create leverage, highlight repeat offenders, and help regulators decide where to focus enforcement that ultimately benefits future buyers.

Conclusion

Law and government may seem far removed from your shopping cart, but they quietly set the rules of the game every time you buy. Disclosures, safety standards, licensing requirements, privacy rules, and dispute procedures exist to help you make informed choices and fix problems when they arise.

When you read disclosures instead of slogans, treat return policies like part of a contract, choose payment methods with strong protections, verify compliance, and tap into complaint systems, you’re not just being cautious—you’re using the legal framework already built for you. The more you understand your rights, the more each purchase becomes a deliberate decision instead of a hopeful guess.

Sources

- [Federal Trade Commission – Consumer Advice](https://www.consumer.ftc.gov/) – Covers topics like online shopping, warranties, returns, and how to handle disputes and scams.

- [Consumer Financial Protection Bureau – Consumer Tools](https://www.consumerfinance.gov/consumer-tools/) – Explains your rights with credit cards, loans, billing disputes, and provides complaint submission options.

- [USA.gov – Consumer Issues](https://www.usa.gov/consumer-issues) – Central hub for U.S. government consumer resources, including how to report problems and find state-level help.

- [USA.gov – Recalls and Alerts](https://www.usa.gov/recalls) – Links to official product recall information across agencies for vehicles, food, medicine, and consumer goods.

- [National Association of Attorneys General – Find My Attorney General](https://www.naag.org/find-my-ag/) – Helps you locate your state attorney general’s office for local consumer protection information and complaint processes.

Key Takeaway

The most important thing to remember from this article is that this information can change how you think about Law & Government.